What Does Mean Reversion Have to do With My Investments?

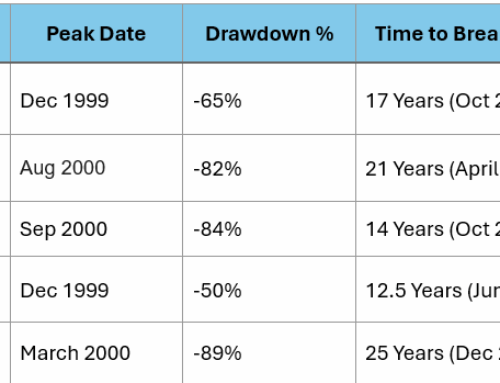

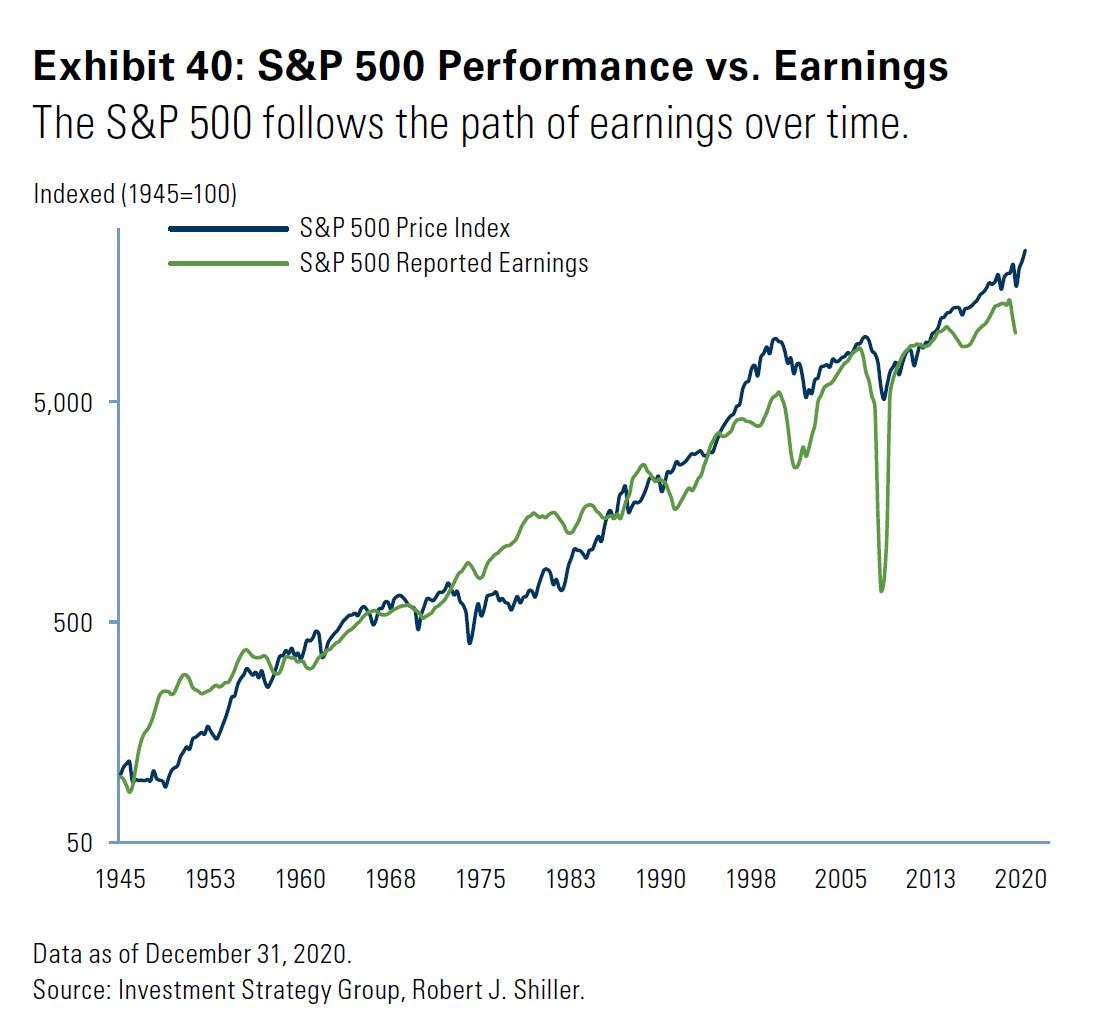

Like the law of gravity, large numbers and their averages or “means” pull with great force. The price of a stock is a function of the factual data that surrounds the profits the business is reporting and the opinion on the security of future profits. Put another way, to measure risk is to look at a company through the lens of cash flows and time. In our experience the more volatile element is the opinion component of a stock price, which reminds us of Warren Buffett’s comment that in the short run the stock market acts like a “voting machine” (reflecting all kinds of irrational attitudes and expectations), while functioning in the long run more like a “weighing machine” (reflecting a firm’s true value).

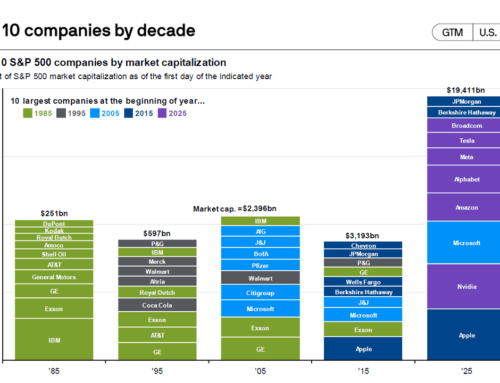

Currently the opinion or voting in our stock market prices is high on a relative basis (or the long term mean) which means that for some very high-profile stocks like a Zoom or a Tesla the fear of missing out can drive the price higher, even when nothing new has changed in the company’s profit projections. Our Quality Investment process is built to help us identify and avoid owning companies that have a serious disconnect from their earnings and their price. Our stock buying process is accompanied by a stock monitoring and stock selling process that helps us sell into the unwarranted rally of a company and reallocate those funds to companies whose stock price is more closely aligned with its profits.

Currently the opinion or voting in our stock market prices is high on a relative basis (or the long term mean) which means that for some very high-profile stocks like a Zoom or a Tesla the fear of missing out can drive the price higher, even when nothing new has changed in the company’s profit projections. Our Quality Investment process is built to help us identify and avoid owning companies that have a serious disconnect from their earnings and their price. Our stock buying process is accompanied by a stock monitoring and stock selling process that helps us sell into the unwarranted rally of a company and reallocate those funds to companies whose stock price is more closely aligned with its profits.

Unlike gravity, what goes up in the stock market doesn’t have to go down right away, but the long-term average price for the S&P 500 is 17 times the annual earnings per share. Like the tides of the ocean an astute investor with a committed process should be able to manage their investments appropriately.

Hopefully by the time the next edition of the Quality Investment Report comes out we will have plans in place for another client gathering. We imagine some of you, like us are “at the ready.”