A Story We Hear Often

The Jones family financial success has been the product of a lot of hard work, with a liquidity event that removed any rudimentary financial concerns but has opened a potential pandora’s box of new issues. Creating wealth while running a responsible family can seem simple compared to the new task of building a legacy for future generations of their family.

Worries and concerns about the legacy planning

process for wealthy families.

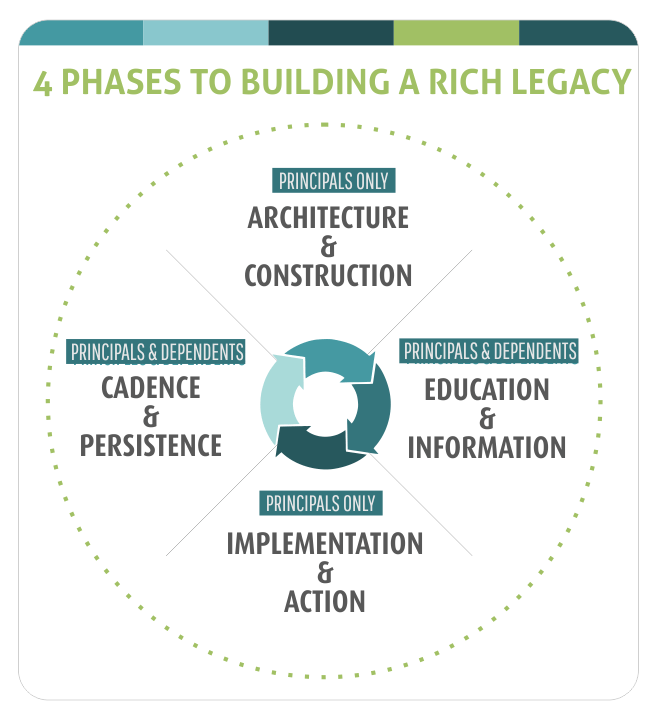

The DLK Four Phase Process

PHASE 1

Principals Only:

Architecture & Construction

PHASE 2

Principals and Dependents:

Education and Information

PHASE 3

Principals Only:

Implementation and Action

PHASE 4

Principals Only:

Cadence and Persistence

Putting it all together

Building and maintaining a rich legacy plan with your

family involves a dynamic group of collaborators and

stakeholders. The DLK process allows the principals

and dependents to work from a central vision and

mission that uses consistent cadence and clarity to

keep all parties informed and empowered.

Our Services

![]()