A Story We Hear Often

Greg and Mary Appleton have been dreaming of retirement for the last ten years. With Greg at 64 and Mary 62, their earning years are ending. Living within their means, saving for retirement while struggling to pay for their kids’ college has been the road they have traveled. Even so, they have their health, family, and the investments inside their company’s retirement programs have grown.

They are excited to retire and let their nest egg allow them a little more time in the day. However, Greg and Mary have encountered one problem, they have not been on the same page about making investment decisions before, and there appears to be so many choices. They have a great relationship, and yet they know they make decisions differently. The stakes are higher now, this nest egg is all they have, and not every investment they tried along the way on their own worked.

Memories of that timeshare they bought in Mexico, or the $5,000 they invested with a neighbor on a local restaurant that “couldn’t miss” are still fresh. Around every corner lurk dubious ‘what if’ scenarios, and every publication and institution they speak with keeps asking them about risk tolerances. Is zero an answer? They need this to work!

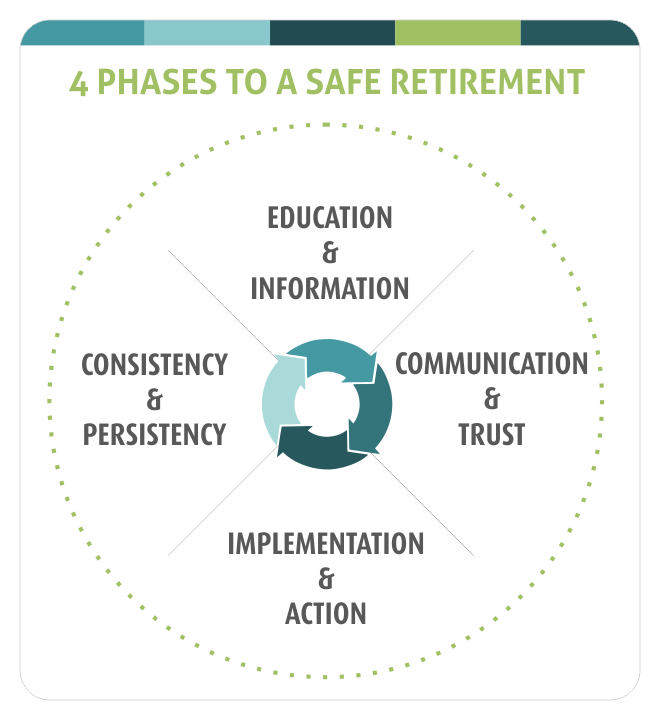

The DLK Quality Investment Process

Into this drama steps a group of professionals who have taken a fiduciary pledge to put your interests before their own. DLK Investment Management is a Registered Investment Advisor (RIA) that creates the financial plan for your retirement years, walks you through all the options, and sits with you until all your questions are answered. Our professionals understand that this time of change isn’t just about you getting used to working less, it is about you trusting an investment process MORE. Trust is hard, which is why our team uses a Trust but Verify solution for our clients, where we over-communicate in the beginning of your retirement years, so you can ease into this new phase of your life.

Worries and concerns about the retirement

process for long time employees.

Our Services

![]()