What 20 Septembers Can Teach Us

September 11, 2001 was one of those moments in time where you know exactly where you were when you learned our country was under attack. We have clients who were in the air and experienced the immediate grounding of all aircraft no matter where they were in their route. Clients and fellow work colleagues lost friends who died in the attacks. The tragic events changed the course of history.

Rarely do we have occasion to remember something together that happened 20 years ago, and as this grim anniversary loomed, we started looking at the time period through the lens of our investment management discipline. We were curious about two questions, what would $10,000 invested in January of 2001 be worth today, and how have the leading companies in the averages faired?

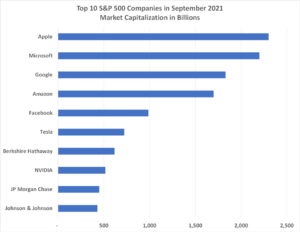

What Happened to the Big Companies?

As you can see in the charts below, 9 out of the 10 top companies in the S&P 500 from 2001 have changed and the tenth, Microsoft, went through a complete overhaul of its business to return to its current standing. Very few of the companies went out of business with a notable example being Enron. They just stopped growing and were replaced by faster growing companies. The other thing that jumps out is within the 10 industry sectors at the time, there was massive rotation out of industrials and financials, and into information technology.

These changes show that the even the indexes are practicing a form of active investment management. General Electric provided a negative return of 71%, Exxon Mobil increased in value by 26%, and Intel, a darling of the age at the turn of the century returned just 86% over the entire 20 year period. That means if you had invested $10,000 in each of these companies and held them you would have $3,100, $12,600 and $18,600 respectively. Your $30,000 in 2001 would be worth $34,300 today which would actually be worth less because of inflation.*

In stark contrast companies like Apple, Amazon, and Google returned 55,514%, 22,213%, and 5,455% respectively. We hesitate to even share what $30,000 invested 20 years ago would be worth today, but if you want to play around with the numbers here is a website that will do the math for you.

What the 20-year analysis shows is that ongoing growth for a company is not guaranteed, and that investments need to be managed on both the purchase and the liquidation sides of the transaction. If you had bought and held the largest companies in 2001 you would not have achieved a 9% compounded return that so many investors desire.

The Quality Investment Process (QIP) at DLK creates a set of boundaries for our team to work within to identify the right companies and to hold those investments, provided the standards we have set are maintained. These great companies must keep performing to make the cut to be in your portfolio.

Looking back at these 20 years we are thankful for our service men and women who protect our country’s freedoms every day. We also appreciate the chance to serve our clients and provide the guidance and advice they request in managing their financial affairs.

*These figures are based on Alpha Vantage’s historical stock data, which takes into account splits and dividends. The most recent closing price is used for the selected symbols.