Whistling Past the Graveyard: Those last few years before you retire.

There are more 65-year-olds in the United States than at any time in our nation’s history. Social Security payments have been pushing past this date for a while, but for many, the goal remains the same – to put down the shovel of worry and toil and to enjoy the fruits of almost 40 years of working and saving. Thirty years ago, a vast majority of our population would exchange the single paycheck from their employer for two paychecks for the rest of their lives – one from the companies defined benefit plan (pension), and the other from the U.S. Government (social security). The retirees of the past still had to live off a budget, but some higher power took the risk that there would be enough money to pay them for the duration.

Today the vast majority of working professionals have had a series of jobs with different companies and have been saving for retirement through defined contribution plans 401(k)’s – which have grown tax deferred for decades, but have put the burden of future cash flows on the retiree. The Social Security check is still a pension, but it covers only the most basic of needs for most.

This new landscape creates a mandate for the prudent professional in their early 60’s to understand how bonds and stocks and cash work together to provide for what can be 30 or 40 years of cash flow. An entire industry of Financial Planning has been born, and DLK is proud to have two Certified Financial Planners (CFP) designees on our team. Having your own customized financial plan as you retire will help you create a personal risk adjusted return (RAR) for the duration of the plan. This RAR will then impact how you will allocate your investments into stocks, bonds, and cash and you may want to start making some adjustments in your 401(k) even if you are several years out from retirement.

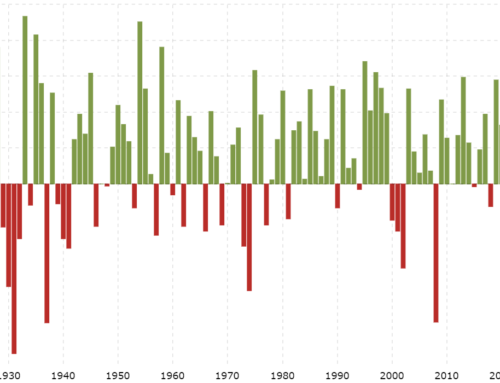

The adjustments can be in your allocation to stocks, which historically have provided a nice hedge against inflation, but also have the largest swings in price. The last four years of the post pandemic have taught us that many of the sectors in the economy can move together. This is a change from several decades ago and further suggests those close to retirement should understand what they own and seek professional guidance as their work years are shrinking. Helping the investor plan for and allocate correctly accordingly during these critical years is a key role our team plays. No one should be reading out of a free guidebook off the internet or a TV ad after 40 years of saving. It takes rigor and discipline to establish a plan and to stick to it amidst the headlines of our current climate.

Another thing that takes rigor is our Investment Committee’s work to identify the companies that we will invest in both on the stock and bond side of the equation. Our results from the end of 2023 can be found here:

Quality Equity

Quality Fixed Income

Thank you for your readership and your friendship.