“The dividend from an investment can keep you warm while you wait for the stock price to rise.”

This adage seems to be worth analyzing for the mature investor who needs to allocate money to stocks but may not have the time to recover from a 30% price drop. When a public company is growing quickly and is less than 10 years old, the board of directors will often encourage the management to put all available profits into further growing the company and if possible, widen their competitive advantage moats. Capturing and protecting more market share would appear to be the wise course. The investor is rewarded when the earnings grow, and the price eventually follows.

As companies increase their competitive advantages and start to see an inevitable slowing of the year over year growth rates (think how hard it is to triple, then triple, then triple again). The board of directors, in an effort to meet their fiduciary duties, will suggest that the company allocate some portion of the profits back to the investors in a dividend.

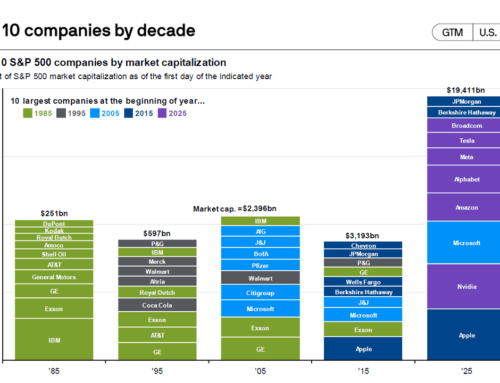

This does not mean that the company is no longer growing or investing in new sectors to leverage their customer base or find new customers. Apple moved from computers to music to phones to services. Microsoft moved from software to cloud storage. Dividends are a natural evolution and allow the investor a built-in safety mechanism to keep up with inflation, regardless of whether the market’s opinion of the company is hot or not.

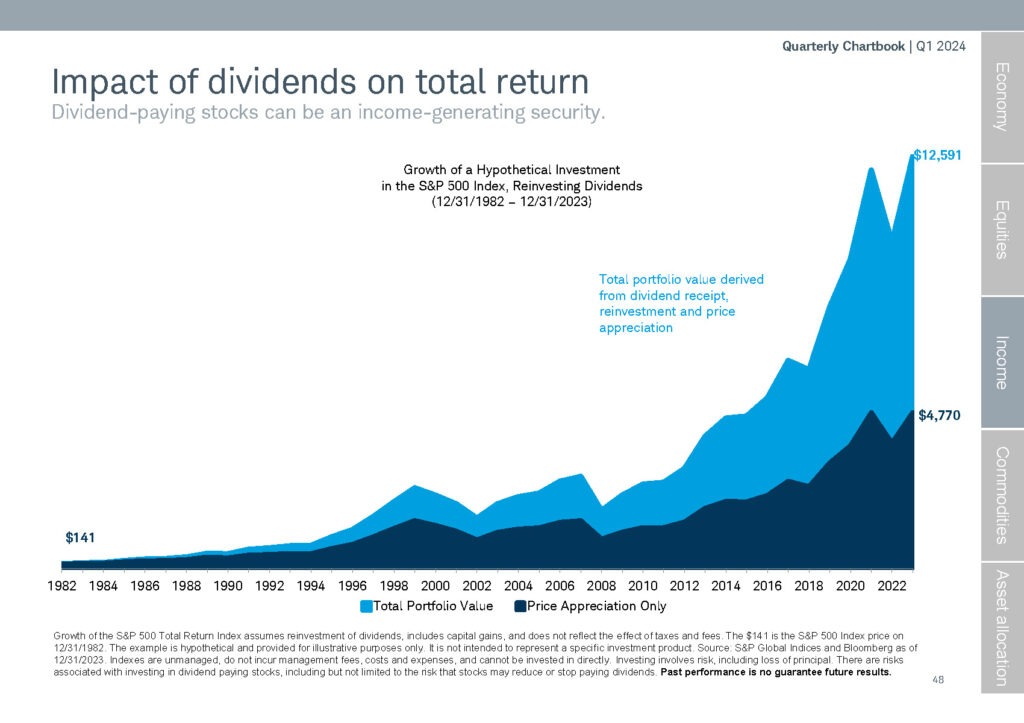

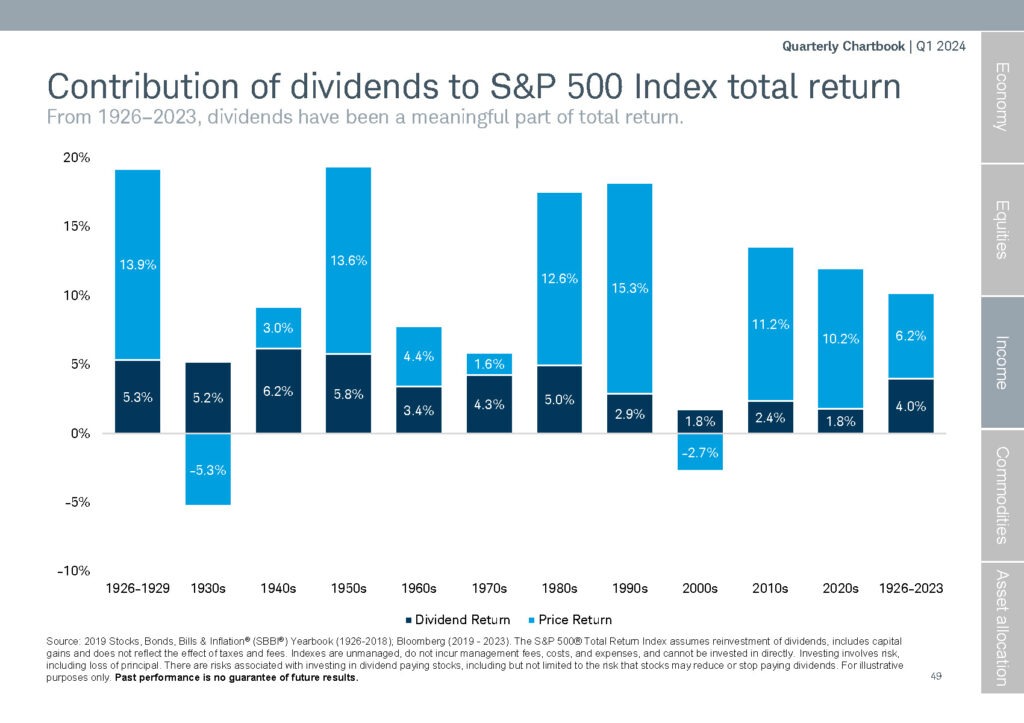

Per the two charts below you can see the benefits of investing in companies that pay a dividend. The DLK Quality Equity Portfolio currently has 34 companies in it and 32 of them pay a dividend. DLK’s current yield is 1.6%, which is more than the S&P’s 1.3% and the QQQ’s .6%*. It is important to note that DLK does not reinvest the dividends but rather re-allocates the funds to the entire portfolio. This is an important rebalancing tactic that allows us to ensure that one or two companies do not become too heavily weighted relative to the other investments.

This and other tactics are part of our effort at DLK to reduce the volatility of the portfolio. It’s important to investors, who in retirement have less time to recover from large downturns relative to an institution that has a longer time horizon.

*QQQ Information from www.stockanalysis.com