Retirement Experts Want to Change Your Rule of Thumb

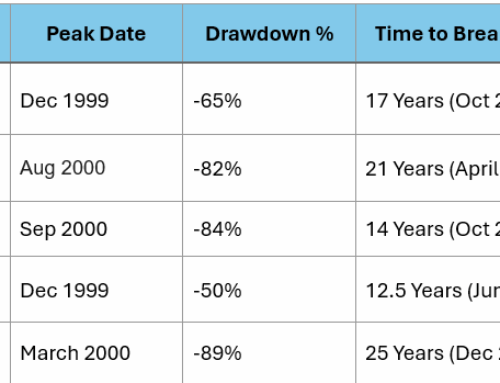

Rules of thumb can be helpful in many areas and one of the old saws of retirement is the 4% rule, which states that if you don’t want to run out of money you can pull out 4% of your portfolio, which may include principle, on an annual basis for living expenses. Mutual fund rating giant Morningstar recently published a white paper where they researched back to 1926 and looked at a series of variables and are now suggesting that the real number should be closer to 3.3%. It is interesting that they are looking at the current low interest rates and stock market valuations in their projections for the future. You can read the entire report here.

The most important take-away for people who are considering retirement is to have a several year period of semi-retirement in which they still have some income to counteract the impact of a large drop in the stock market in the first few years. If in the first few years, the returns are within the first standard deviation the full retirement can commence with an added cushion from the income. If the returns are outliers on the downside, the income allows the portfolio to not have to sell when valuations are low. Seldom is this strategy discussed in the large publications and yet at DLK we consider this strategy a vital part of any five year pre-retirement plan.