Being substantially invested in the stock and bond markets in 2021 was like playing Monopoly, and landing on Community Chest 12 times in a row and always getting $200. 2022 seems like the opposite…where you end up in jail and even though you passed GO, you don’t get the $200. It can make people want to stop playing the game or get off the roller coaster, and yet timing investments requires being right with many different variables that few can master.

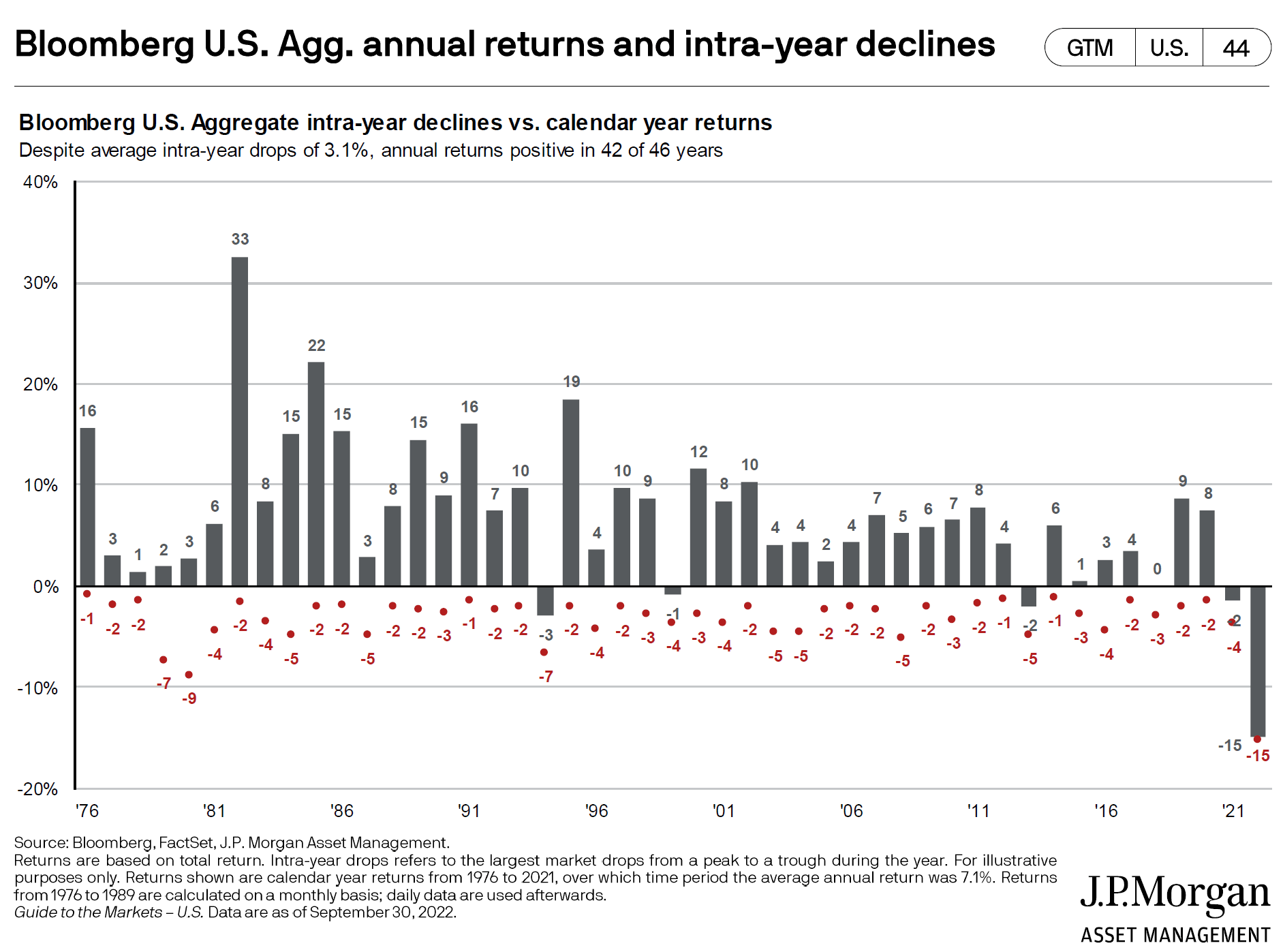

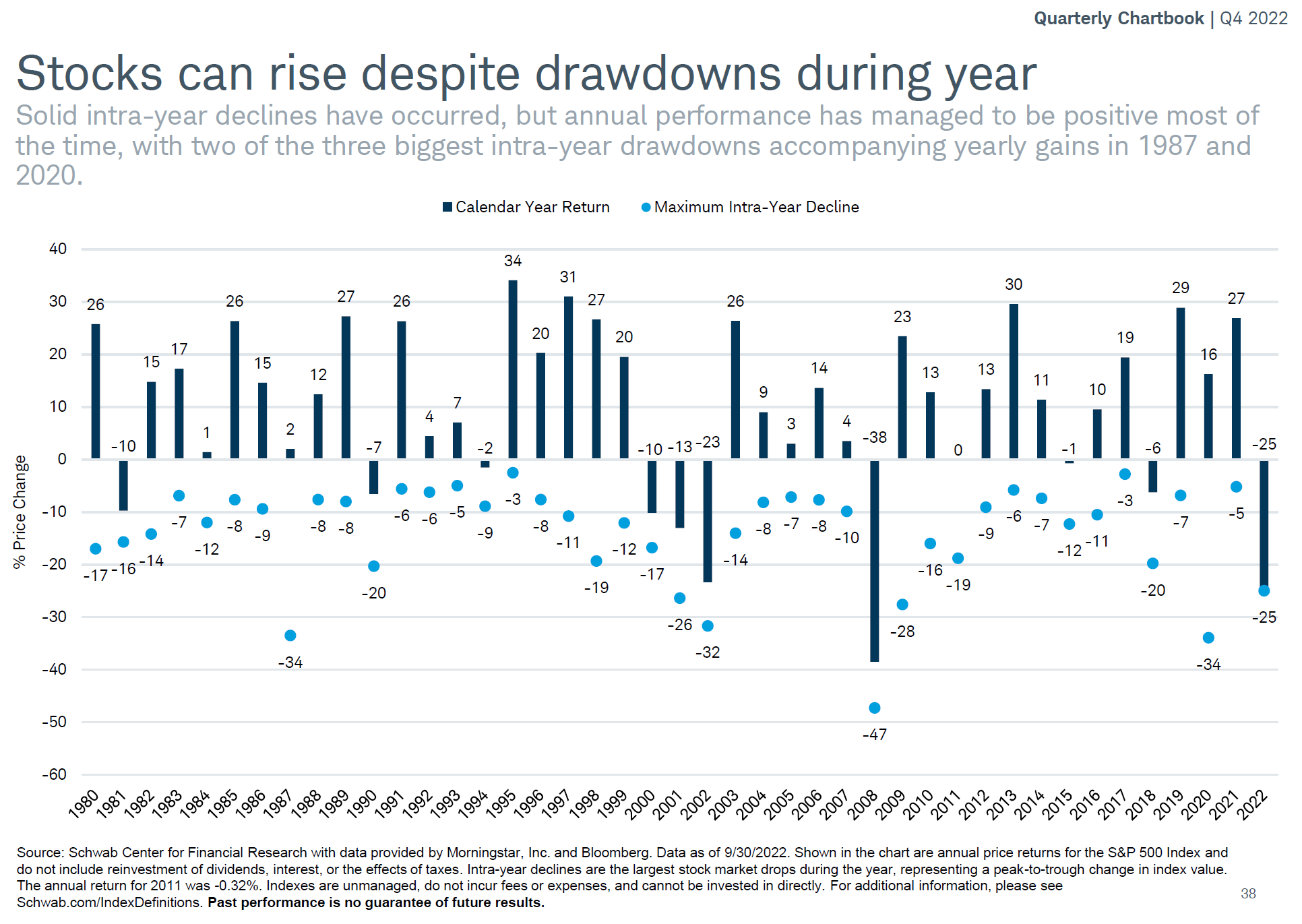

Owning a piece of or an obligation of a quality business is the way to go. This holds true even when investor sentiment is making the shares you own worth less in the short run. The two charts below show that during a calendar year there can be significant swings to the downside and yet they finish up for the year. While the forward-looking aspects of the stock market make it more likely to sell off on bad news, even the bond market has consistently gone through periods of weakness.

The financial headlines for stocks in 2009 were littered with exclamations that it had been a lost decade and yet the following 10 years more than made up for the losses. Today, those same media outlets are talking about a lost decade for bonds, and at DLK we will be running our quality investment processes week in and week out selecting the appropriate bonds for our clients.