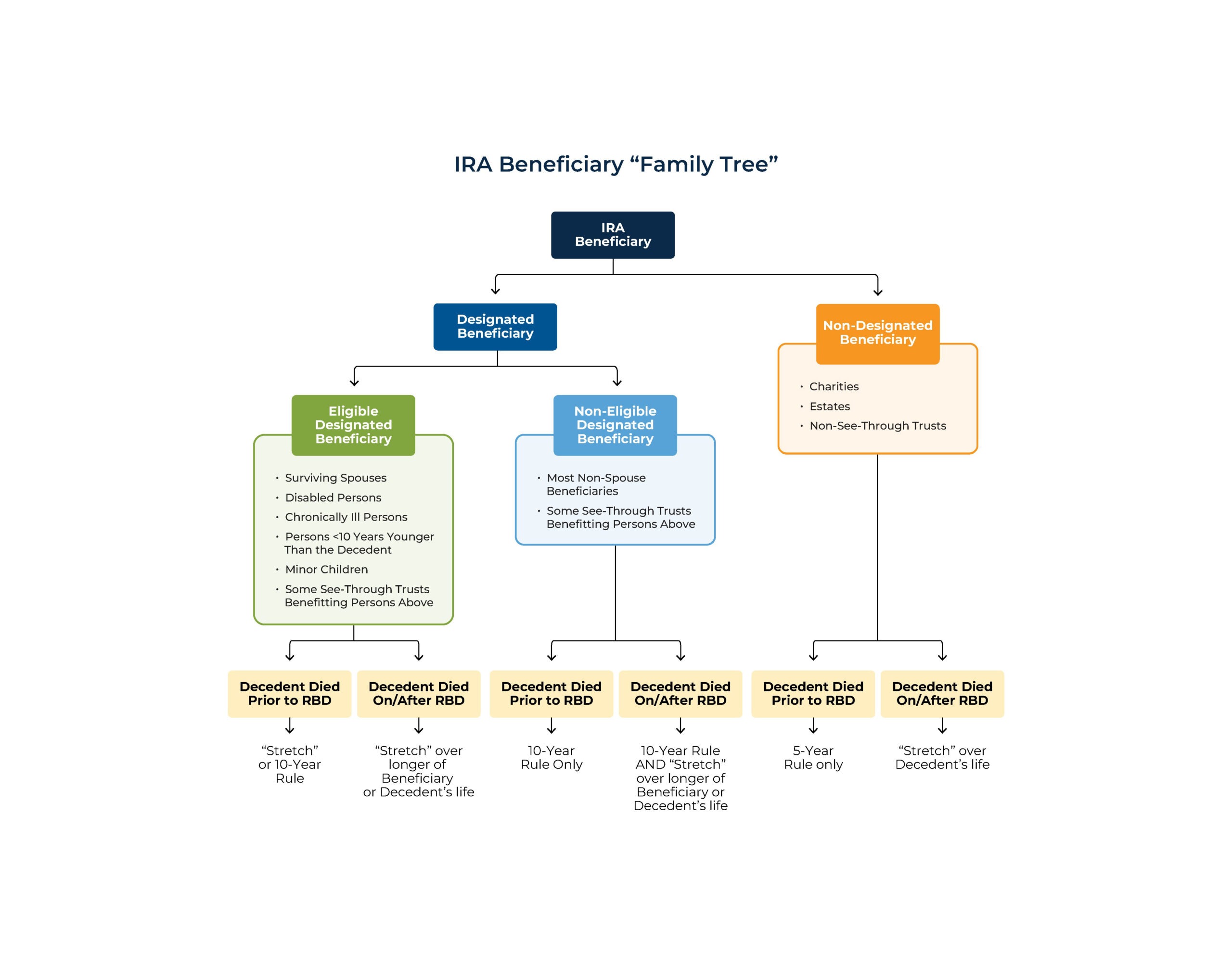

Don’t Forget Your Contingent Beneficiaries

Each fall we remind clients to review their retirement account beneficiaries—and their contingent beneficiaries. If you have a friend who handles the investments by themselves, you could forward this reminder to them, and they can call us with any questions.