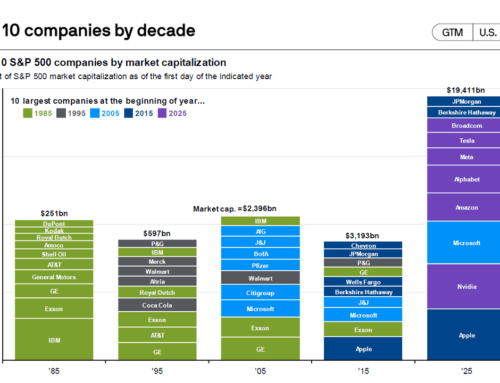

Charles Schwab is a major partner for DLK, they act as our primary custodian. Each quarter we receive a series of slides that outline how they are viewing the investment climate and other key factors that enable us in our advisory business. They recently shared a slide that highlighted the impact of owning individual bonds, which is also known as fixed income, due to the nature of how the investment pays its owner a consistent dollar amount on a cadence.

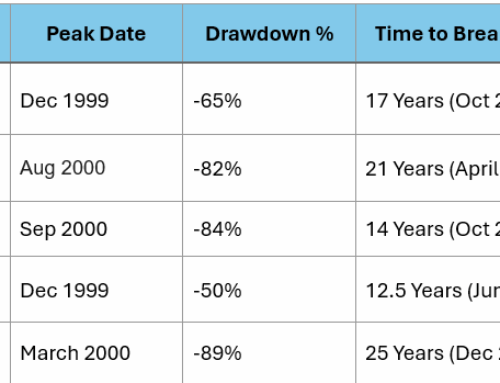

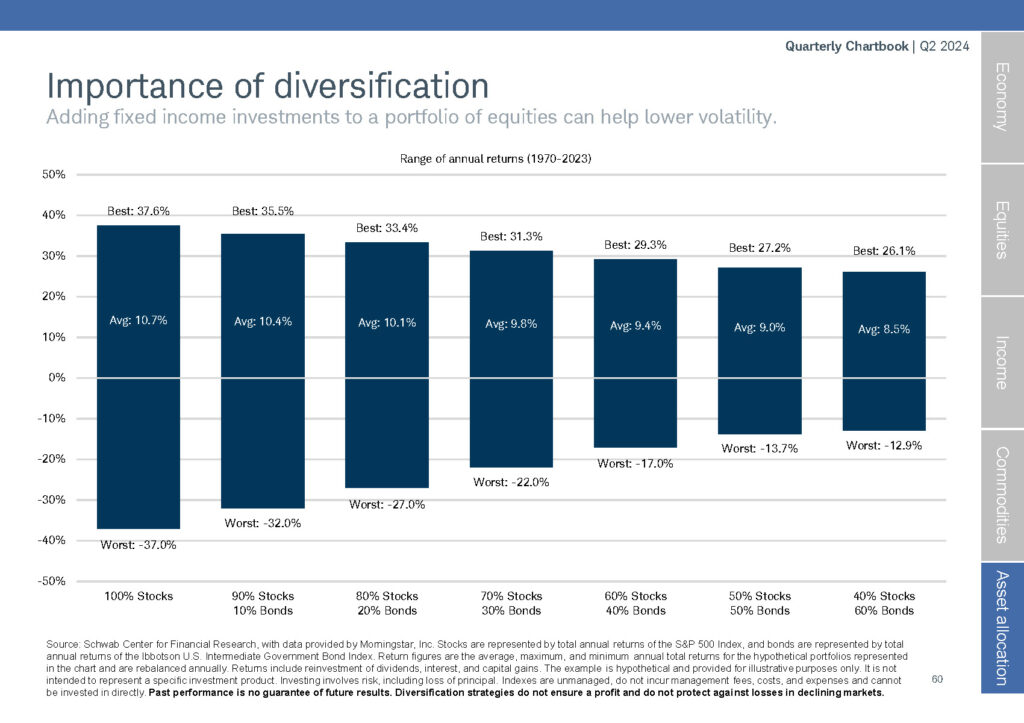

Going back to 1970 this slide shows the positive impact on downside protection, that even a 20% allocation to bonds can have on a portfolio. We have highlighted in past editions of the QIR how important downside protection can be to a retiree’s sense of wellbeing, when they are not certain they have the time to wait out the current period to be made whole.

This slide makes a great case that investors should consider owning bonds. But how should you own bonds? Our position is that, if possible, you should own the bond and not own a piece of a bond in a bond fund. This may seem simple, but one of the quirks of our financial system is that owning a share of Apple stock is easier than owning a piece of Apple’s latest bond offerings. In addition, there is a very large sales system in place to convince you that you should not try and own the actual bond and just take the path of least resistance and buy a bond fund.

The Wall Street Journal recently had a small article that highlighted what we wrote about in the fall of 2022, why you should not own a bond fund, especially in a non-retirement account.

In this article, the author Derek Horstmeyer states that when you own the bond you have clarity on the actual company, and you can control when the bond matures which creates the cash flow you may require. Having different maturities for your bonds is called laddering and you can’t ladder anything in a bond fund. In a sense, when you own a bond fund, your ladder is literally on the wrong wall.

The other key problem Horstmeyer points out is that if interest rates spike higher like they did in 2022 and 2023 the portfolio manager of the bond fund will be forced to sell bonds which can create a tax issue for the investor who didn’t sell. Imagine the fun of writing a check to the IRS for an investment that has lost money. That is exactly what happened at the beginning of 2024 for any investor who owned a bond fund in a non-retirement vehicle.

Helping our clients know what they own and giving them control over how they invest is a primary goal at DLK. Keeping investors away from the product of the month that the large financial advisors are marketing sometimes makes us feel like the nutritionist advising a client to just eat whole foods and stay away from anything in a bag or a box!