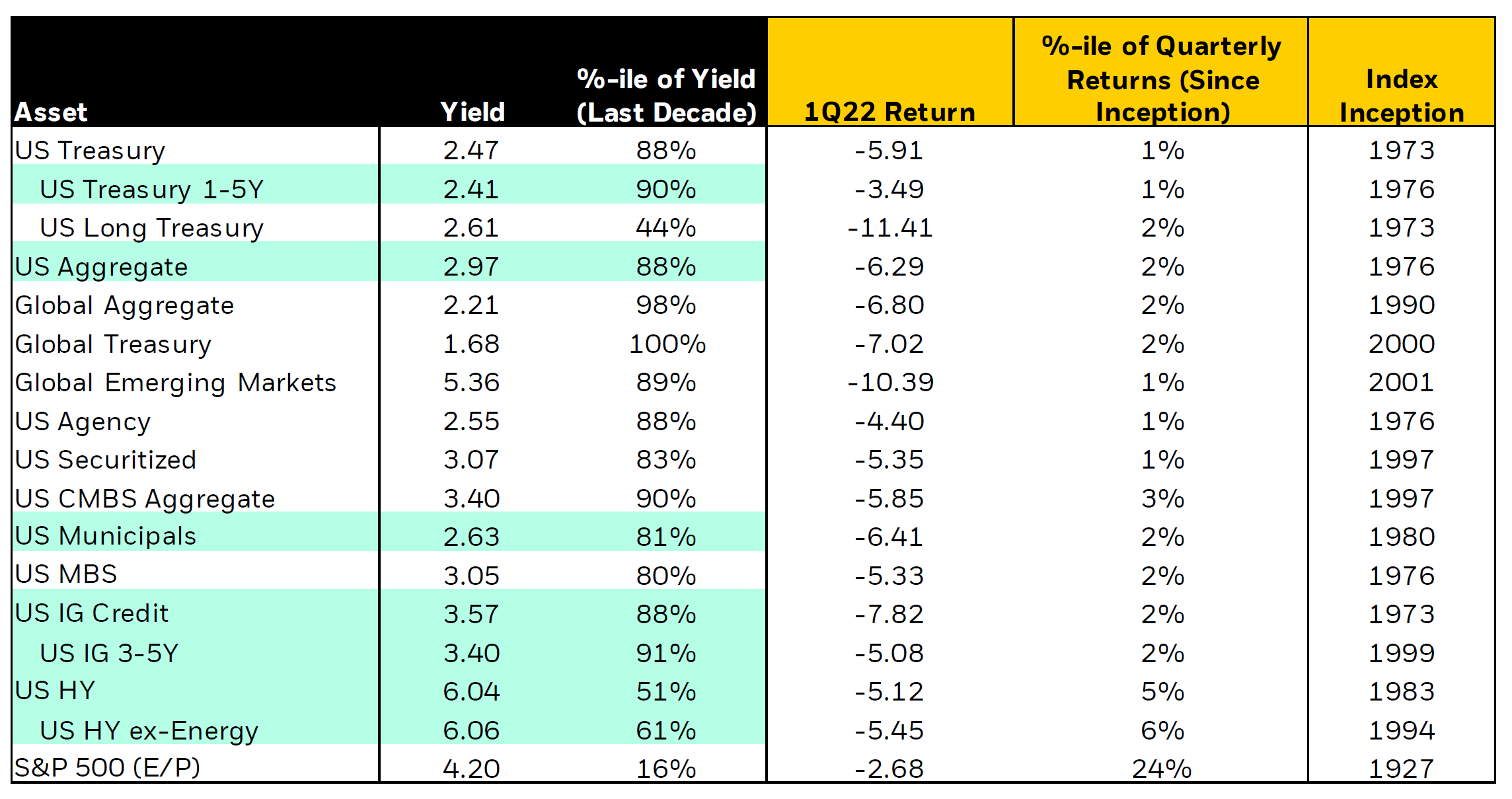

Source: Blackrock Fixed Income Office. Index returns are shown for illustrative purposes only.

When Does a Bond Not Act Like a Bond? When it is in a Bond Fund.

Historically investors bought and held corporate or municipal bonds to earn a fixed amount of income for a certain period of time. Our industry named this yield and duration. The investor could sell their bond for a gain or a loss depending on interest rates, but if they held their bond to maturity the yield was fixed and the principal was returned.

In recent decades financial institutions of all types have started creating a product called a “bond fund” that would only hold certain types of bonds but that could provide easy liquidity for the investor and allow them to invest smaller amounts of money. These bond funds have swelled with investors and one thing has generally been true, there is always more money coming in then going out. This allowed the managers of the funds to not be caught short having to sell something at a loss if interest rates went the wrong way.

That was until the first four months of 2022 when interest rates started going up and investors started leaving the funds in mass. The managers were forced to sell bonds to meet the liquidity needs of the investors and they sold the bonds at a loss which further hurt the price of the actual bond fund itself.

The bond fund returns are reflected in this busy chart, but the point is clear: investors should own individual bonds if they can afford to.