How We Have Saved and Learning to Spend

When looking at our country’s demographics, the largest financial institutions have observed that we are in pretty good shape relative to other countries. Our workforce is not as old as either Japan’s or Europe’s which is a key driver in the economy. The common issues our pre-retirees and retirees face are how they have saved and learning how to spend.

How We Have Saved

A 2019 comprehensive study of over 40,000 accounts conducted by Vanguard investments found, that left to their own devices, 4 out of 10 investors would either have 100% of their investments in either one or two investments or in cash. These two investor profiles mirror the Aesop fable The Tortoise and the Hare except in this story a third character, inflation, defeats the tortoise.

The poor tortoise, one of the timeless truths of our financial system is that money held at a bank is insured by the federal government and in a safe place, but that money is a tool for the bank to profit and the saver can easily lose their buying power over time to the cost of goods or inflation. A large percentage of our population still use their local bank as their primary savings institution.

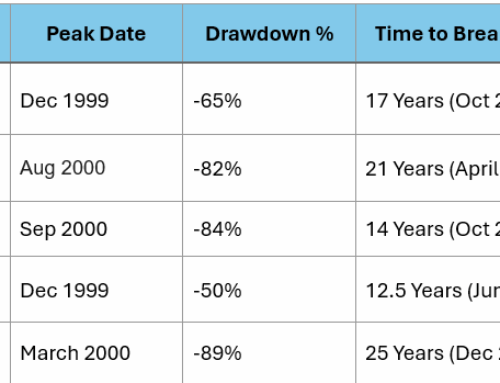

The hare has always been distracted with a bent towards unrealistic comparisons like trying to measure up to a standard that isn’t realistic. This can lead to taking outsized risks like having 100% of your 401k in the company stock. When asked about the decision, many will quote Rockefeller or Buffet, that concentrated positions are the only way to create real wealth. However, they are missing the point that those scions each also had mountains of cash to keep buying when their stock fell out of favor.

Even with these challenges as individuals reach 60 years of age there are key mistakes to avoid and proactive steps to take to plan for a 30 and sometimes 40-year retirement.

Learning to Spend

It may come as a surprise, but many people in their 80’s don’t have much in common with Kim Kardashian and her sisters. Black Rock’s study of the octogenarians showed that even when they were well into their retirement, they had over 80% of their pre-retirement savings left.

They called it the retirement paradox: “Even people who know how to save for retirement still don’t know how to spend for it.”

The data brings up a key challenge that can box people into feeling very alone. The hard questions of: Can we afford to do this? Can we help pay for our grandchildren’s college tuition? Can we host a big anniversary party? It is at these moments that having a close relationship with a financial advisor can help.

Regardless of the individual financial issue you or a friend may face, there is a mountain of information that your advisor can collect and organize to help you efficiently navigate the options and build consensus on the right course of action. What the research has shown is that when we try to advise ourselves, we are either in court without an attorney or on the operating table holding the scalpel.