The benefits of being a prudent buyer: what shopping for fruits and vegetables has in common with stock and bond selection.

Every day fresh produce moves from the fields to the trucks to the grocery stores and eventually on to our kitchen counters, and no one in that supply chain wants to select or purchase something that is about to go bad. There are keys to picking the right fruit, and for those that do it daily they have a process. The buyer at Safeway knows where the fruit is coming from, how long it has been in transit, and the general conditions of the current growing season. Then they have a way to inspect the product as it hits their doors and to cull the bad product. Finally, the shelves and counters of their stores have employees who present and care for the fruit daily. The final prudent buyer is the grocery shopper who has a plan in mind for themselves or others with how to prepare the fruit for consumption.

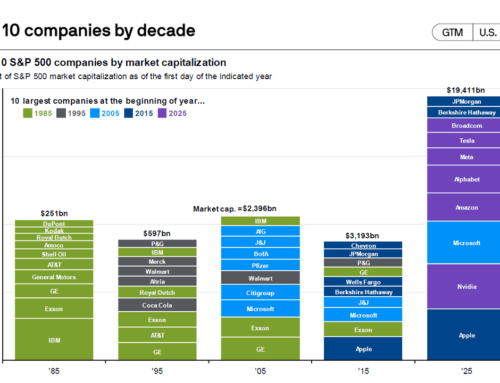

We find it interesting that our Quality Investment Process has so many similarities. We start off with 4,000 publicly traded companies and then narrow that large number down by a series of constraints to several hundred companies in the eleven sectors of the economy. We then further analyze which companies are the best positioned for the future and, importantly, the price it costs to acquire the shares of that company.

One of the unique challenges in stock and bond selection is the fluctuation in pricing. Imagine if a batch of apples at the store weren’t all priced the same and the best conditioned apple started to cost three or four times that of well-conditioned apples. An astute buyer who knew their timetable for consuming the apple might not be willing to pay for the top priced apples. With stock and bond selection, this is often the case. The highest performing companies often having inflated share prices which makes the relative value and risk associated with owning the shares prohibitive.

The prudent buyer of produce, or almost anything at scale, has a process for knowing why they own something and then manages that inventory with a close eye for quality. Our Quality Investment Process is the daily focus of our investment committee. It is why we don’t own a small share of 500 stocks or an even smaller share of 2,000 stocks. We don’t see any reason to own something that might be rotten.