Is Anyone Ever Really Happy with Plan B?

Helping people plan for an uncertain future is a core business practice at DLK. Adapting to the changes that life can bring makes planning a dynamic process. One of the nuances in planning is having thought through and discussed a variety of outcomes. These can often be called plan A, plan B and heaven forbid, plan C.

Charles Schwab chief strategist Liz Ann Sonders recently wrote a long piece about her career and a quote at the end speaks to why we meet with our clients to update their financial plan.

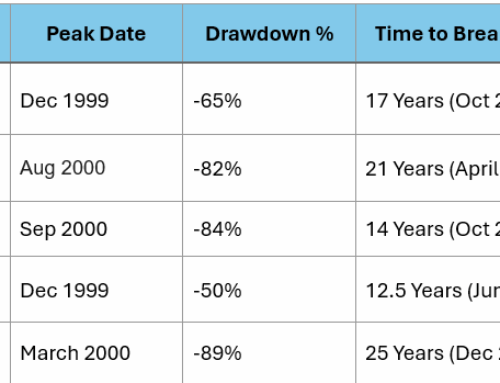

“Try to divine whether there is a gap between your financial risk tolerance and your emotional risk tolerance. Those gaps can be surprisingly wide and often only discovered during tumultuous market periods.”

One of the ways we can learn if these gaps exist is to start with the C Plan first and get our clients talking about what their life would be like in that state.

• How would they function within that state?

• What sacrifices would need to be made?

• Could they be happy, or would they feel like they were failures?

We have learned that most clients are happy to have the discussion and talk through the C Plan and then we turn to the B and A Plans, it becomes easier to dream and save and be on the same page.

Doing some CBA planning when you are five years away from retirement is a key first step in the transition from working and saving to playing and spending. It also is a great framework for managing expectations amidst challenging economic environments.