Do You Know the Codes?

One of our largest partners, Charles Schwab, recently posted a very extensive review of the tax code changes now in effect.

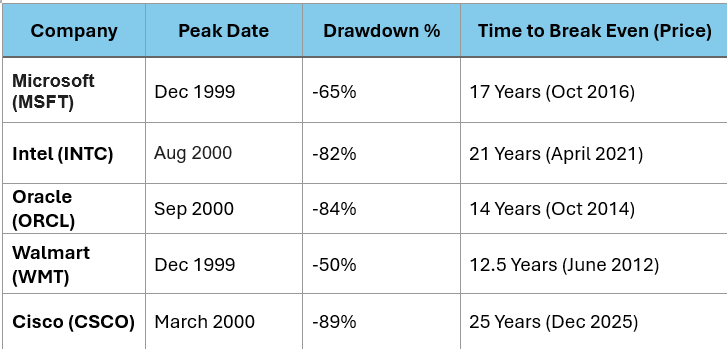

More vs Enough: The Debate

We are always looking to have the “more vs enough” discussion when it comes to taking risks with hot stocks that seem to grab all the financial headlines.

Don’t Forget Your Contingent Beneficiaries

Each fall we remind clients to review their retirement account beneficiaries—and their contingent beneficiaries. If you have a friend who handles the investments by themselves, you could forward this reminder to them, and they can call us with any questions.

The Juice is Worth the Squeeze

The result looks less like diversification and more like concentrated orange juice. And who drinks concentrated orange juice?

What Was Warren Buffet’s Biggest Mistake? What Was Mr. Buffet’s Greatest Advantage?

Mr. Buffett has spoken openly about the error in his ways.

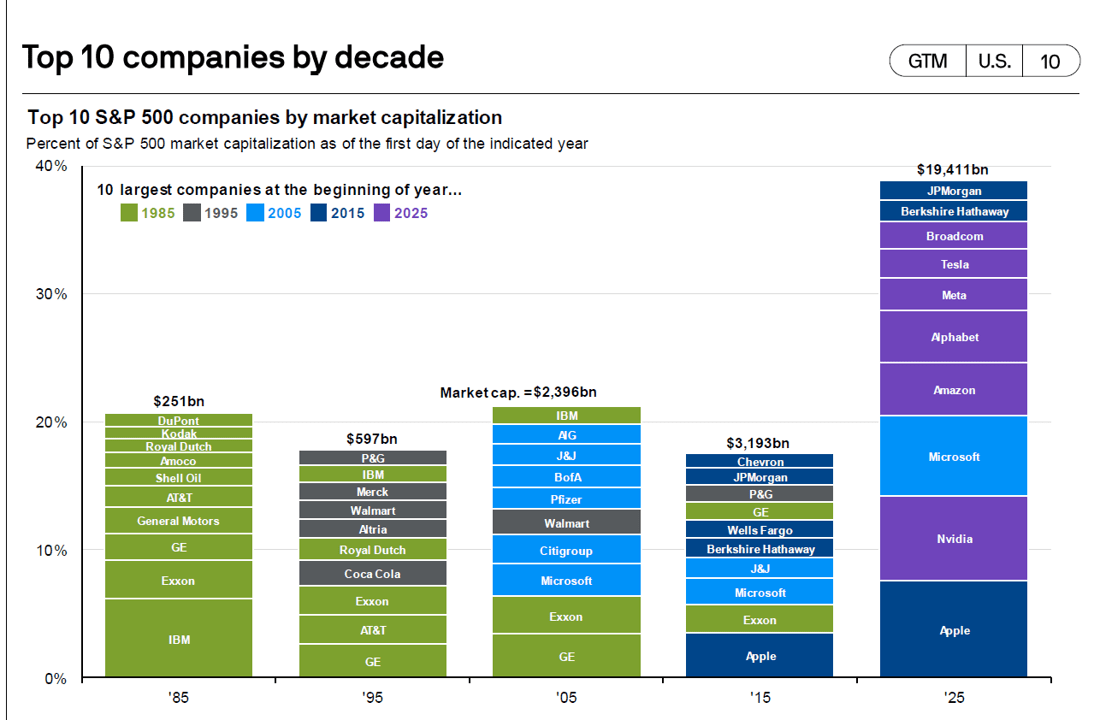

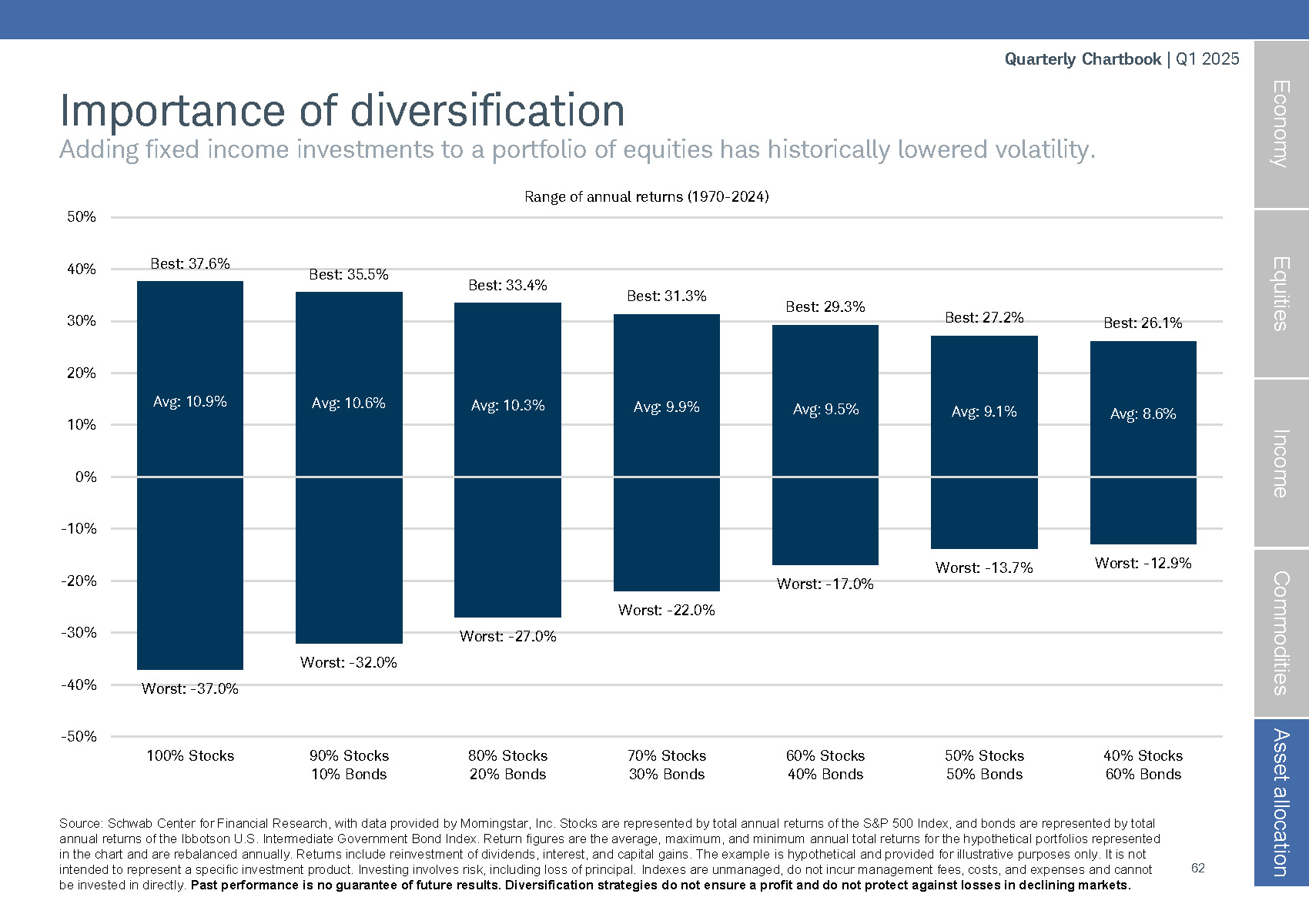

Diversified? What is it?

One of our main goals with our client communication is to educate and to reassure. We seek to elicit a sense of steadiness and calmness amidst tumultuous times.