In retirement you spend dollars not percentages

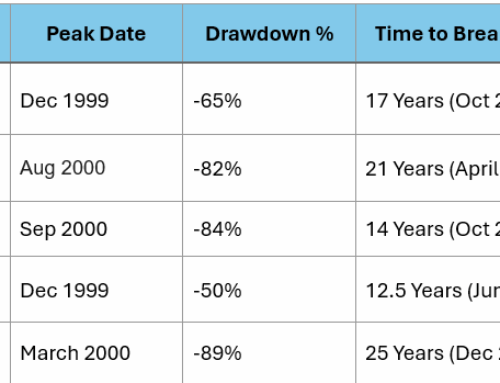

The major media channels have a problem, they don’t know how many shares anyone owns of Apple or Verizon stock, and they don’t know when they were purchased. This makes it very hard for them to say how much in dollars that a company is up or down over a period of time. So they speak in percentages, which is not complicated math, but has some interesting nuances when it comes to investing psychology. Percentages are good at evoking emotions of fear and greed, and the messenger can change the percentage to get the desired effect by moving the purchase date. Here is an example:

What financial media is showing you in the fall of 2023:

• Tesla is up 127% for 2023

• Emotion: Fear of missing out and a dash of greed

• Investors internal dialog: Wow, I missed that one, maybe I should get in now.

What financial media isn’t showing you as often:

• Tesla is still down 40% from its high on Nov 5, 2021

• Emotion: Fear of running out of money and a pang of panic

• Investors internal dialog: Ouch, I have been holding this stock for three years and that is a long time and I need that money for my retirement. How much higher does it have to go until it gets back to even, maybe we should just sell.

Per the investing bible of Benjamin Graham these emotions are what cause many novice stock investors to buy high and sell low which leads them to quit, keep their savings in low-returning bank savings accounts and lose pace with inflation over time.

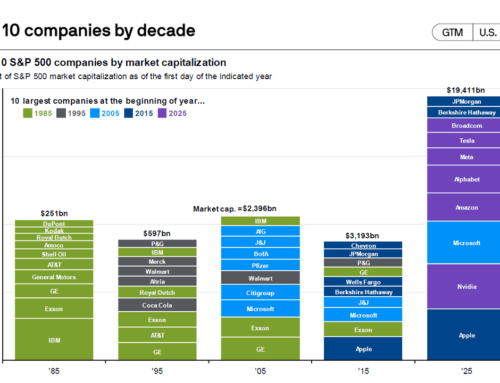

Retirees also have a problem. They spend dollars, not percentages. And unlike a pension fund they don’t have an infinite time horizon. This is why a financial plan is so important. Retirement planning begins with a thoughtful and sometimes challenging conversation about moving from working and saving, to playing and spending. While it may sound easy, the transition is fraught with challenges Some married couples have different views on risk, others enter retirement in vastly different states of health, and still others aren’t on the same page about what happens to their money after they die.

As these challenges are shared and addressed in the planning process, real dollar targets can be set. Then the well-advised client can start to live within their means just like they did as they were saving for retirement. A retired couple or individual should have an annual review of their goals, which helps their advisor team make any investment adjustments and hopefully allows the client to not get sucked into the emotional rip current of percentages.