Caring for a Nest Egg, Whose Job is it?

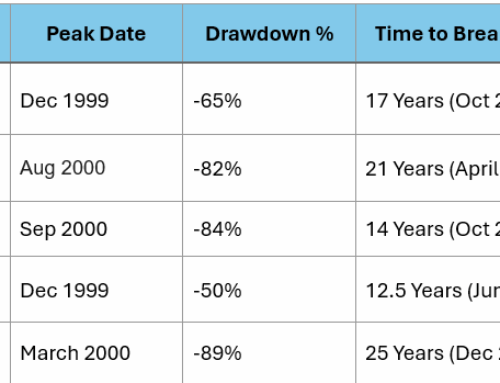

Our most frequent meeting is with a person or couple who are the verge of retirement. Time and good habits have them staring at a large asset in their retirement accounts and a few changes and correlating choices are pending. The thought of not working can be daunting enough, but the accompanying responsibility of managing the nest egg can be equally challenging. The rules for retirees can change from one company to the next, but in most cases the habits and skills go from the simple act of saving and investing, to investing and withdrawing funds to replace the income lost from being fully employed.

Strong points of view exist but can often be juxtaposed. One spouse may want help, the other may be adamant that it is far too simple or expensive. We have noticed that two key elements are needed for clarity and alignment. Those are trust and education.

On the education front we start with the twenty-five to forty years that make up the retirement period, and ask the couple who is going to take the lead on the investments and withdrawal process? Who will file or prep the taxes for that duration and who is going to be the backup person in case of an emergency? Simply looking at the entirety of the time period can shed some new light for a couple that are not on the same page.

The second and maybe more important matter of trust can take time and shared experiences. The number of decisions and processes required to transition from a qualified retirement plan as an employee to a stand-alone family or trust account can begin to allow the client to build the relationships with the people who will be there for them down the road.

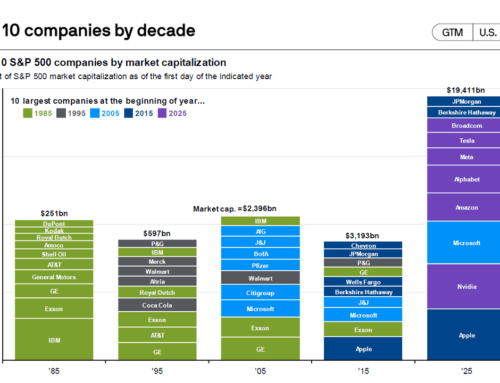

A final point to consider is that over the past 15 years almost every large financial institution has started messaging that retirees should receive financial advice. In fact, the most ardent Vanguard came out with their own research on the matter right about the time they started charging for financial advice.

Managing the transition from working for income to managing your assets to replace that income can be a several year process. Some of the perceived risks are full of noise, yet real hazards exist, especially in the area of non-action which can be a standard outcome when a couple have different points of view. A good rule of thumb to consider is that when you are less than five years from retirement start meeting with a financial advisor as often as you meet with your CPA to handle your taxes.