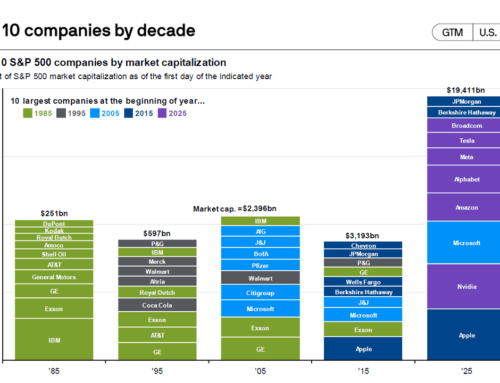

Most of us don’t want either of these alliterations in our life, but the investors holding on to the market cap weighted S&P 500 Index fund are currently experiencing the latter. Bad breadth or over consolidation occurs when a few companies in your portfolio start to amount to more than 5% of your holdings. This is one of the trickiest parts of investing in market capitalization weighted index funds which seemed to be built to create this exposure.

The S&P 500 Index is offered in two versions. The one the financial media markets the most heavily is the market cap weighted option, which tilts the portfolio to have more of an investor’s money in the larger companies. The equal weighted index means you own 0.2% of each of the 500 companies. The two indexes will never have the same allocation, but the market cap weighted index, at different periods of time, can pose some significant concentration risks for conservative investors all while giving off the impression of proper diversification.

What Are the Risks?

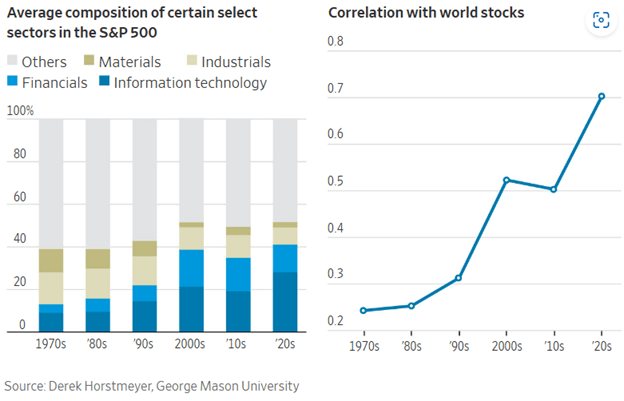

Research by Derek Horstmeyer of George Mason University that was highlighted in the WSJ echoes what we have been sharing with our clients lately. Yesterday’s S&P 500 is not the diversification tool away from the Dow Jones Industrial average that it used to be.

Additionally, the independent Investment Advisor is well suited to match a client’s risk tolerance, because the RIA is structurally different than the Wall Street broker dealer solution of the late 1990’s. We create the solution you need without the branded product the old broker was incentivized to sell you.

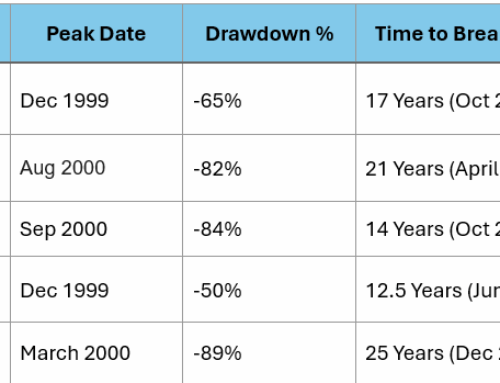

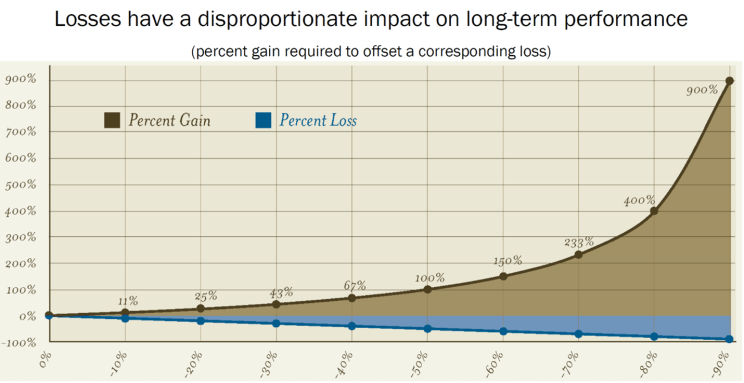

As the S&P’s returns consolidate around a few hot names like NVIDA, Meta, and more recently Tesla, and as the indexes start to increase their percentage in those stocks above 5%, the investor is left with few mechanisms for change other than selling the index and going to cash. We believe the correlating increase in volatility can potentially catch recently retired investors at the exact wrong moment. Below is a chart that shows the percentages needed to recover from a loss of over 30% which starts to become parabolic.

Our role as a fiduciary is to match your investments to your risk tolerance and to do so in the most efficient manner possible. The good news is that as these branded indexes change you are more empowered to use the Investment Advisor channel than ever before, and not be forced to just grin and bear it.

If you or any of your friends have any questions about what percentage of your portfolio should be in any one company, please contact us. Our Quality Investment Process contemplates diversification and thankfully helps our clients from having bad breadth.