Diversified? What is it?

One of our main goals with our client communication is to educate and to reassure. We seek to elicit a sense of steadiness and calmness amidst tumultuous times. More people in America are looking at retirement this year than ever before, and it can be daunting to go from working and saving to not working and spending. We are frequently asked; do I have enough money to retire?

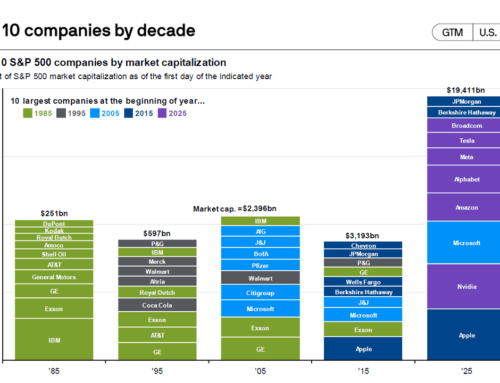

Given the size and scope of this issue there are large institutions publishing robust research pieces on the number of financial advisory firms in place to meet the need and providing insight into what the biggest areas of concern are for people looking to retire. One such piece focused on the key issue people face: how they invested or what is often called their asset allocation.

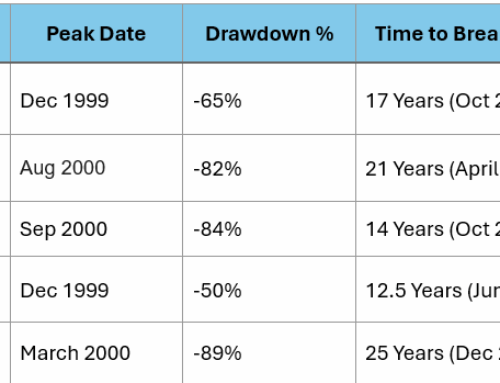

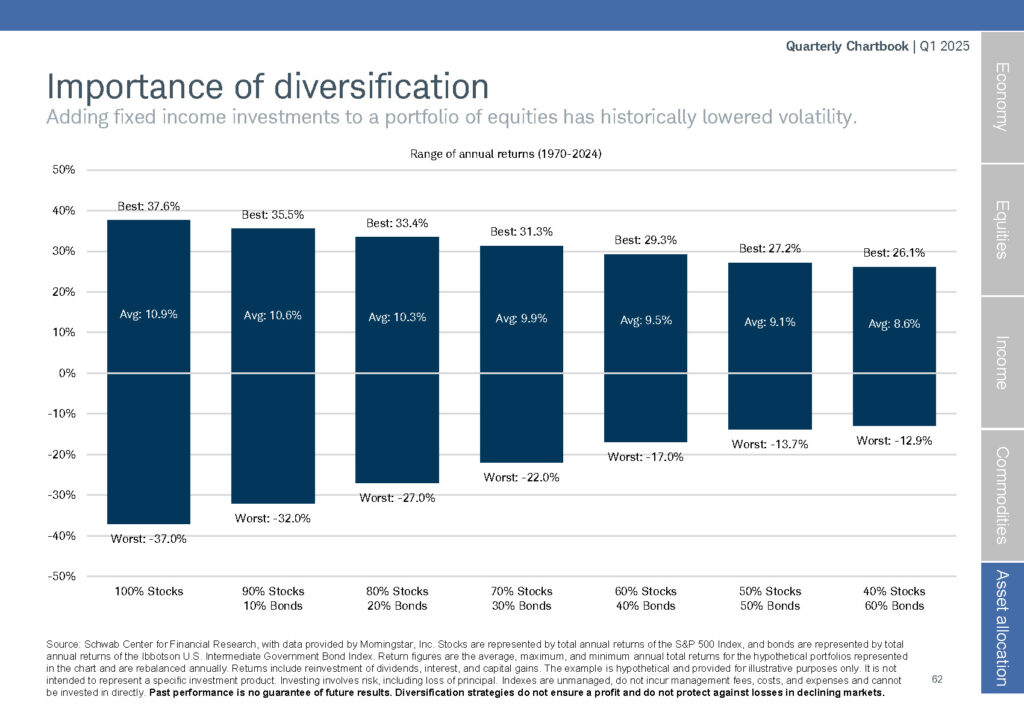

This is a fancy way of asking, how are you distributing your savings between stocks, bonds, and cash? In the largest study we have seen to date, the biggest issue facing most people who were self-directing their savings was to be either 100% in stocks and often the company they worked for stock, or 100% in cash.

Neither of these scenarios are advisable for varied reasons but they speak to the fear or greed mentality that can often grip us.

Interestingly, how your portfolio is allocated can shift as you enter the five years prior to retiring. In addition, the first five years of retirement are also a time of significant importance, which makes the combined ten years super important to becoming educated on the dos and don’ts of financial planning and asset allocation.

As the chart below shows there are standard practices that can smooth out the volatility in the short run, which is exactly what your big ten years is compared to the life of you and your spouse.

Courtesy of Schwab

In closing, we are always seeking, always listening, always learning new ways to gather the information we need to help our clients achieve their financial goals. Our belief is that with consistent and vigilant effort we can navigate the external factors that present themselves in a calm and professional manner. Thank you for your trust and please call us with any questions.