The New Inherited IRA Rules Are Now Final

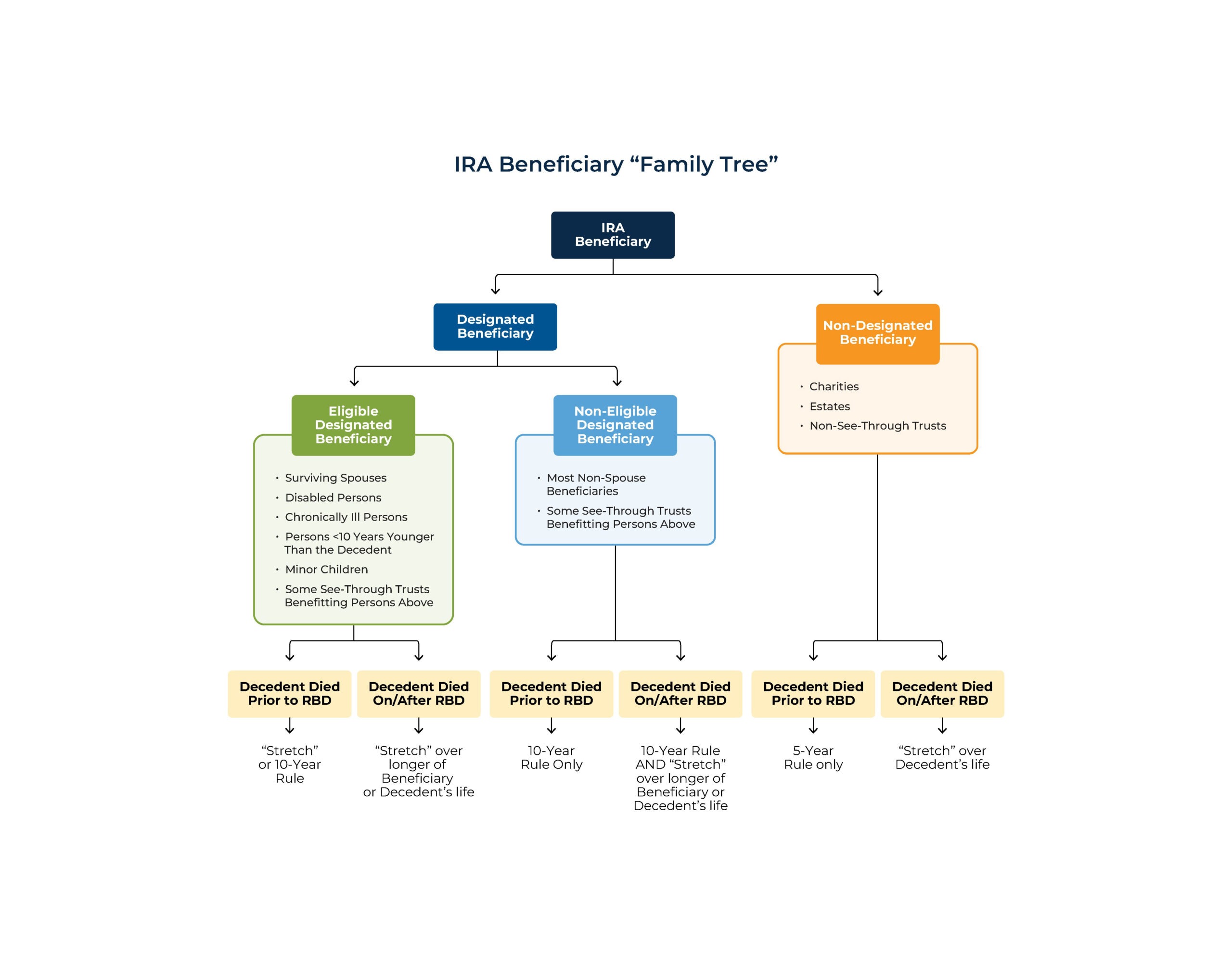

Back in July we wrote about pending changes to how inherited IRAs were going to possibly change as the IRS looked to harvest more revenue for the federal government. The law is now final, and the main story is that in many cases the person who inherits an IRA will have 10 years to distribute it, and the distributions will be taxed as income.

This change was significant enough to warrant a special piece in a November Wall Street Journal article that talks about what was previously thought a crazy notion, that a retired person might consider moving some or all of their IRA into a ROTH IRA. The full article is here.

The ROTH IRA funds that are inherited do not have the 10-year distribution mandate as the funds have already been taxed. Everyone’s situation is different, and conversations with family members can be awkward.

It would appear this regulatory change could be a good reason to start converting a portion of the IRA each year to help the heirs increased tax bill, which will sadly occur at the same time they are grieving the loss of a loved one.

Contact us at DLK for more information or to have a ROTH Conversion analysis done. More information in our article from earlier this year.