Many of our clients have made the leap from working and saving to playing and spending. The nest egg they have created needs to literally last them a lifetime. Shouldering this burden alone can be a challenge and we often get some interesting questions.

Our media channels are good at communicating fear, uncertainty, and doubt (FUD) to keep us hooked on the latest breaking news of a cat stuck in a tree or worse, the chance of a recession.

Which is exactly what we were asked quite a bit this summer.

What do we do if there is a recession?

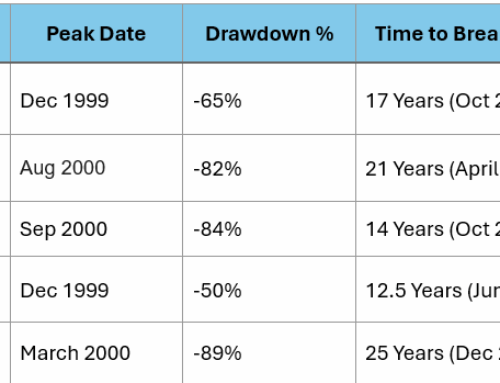

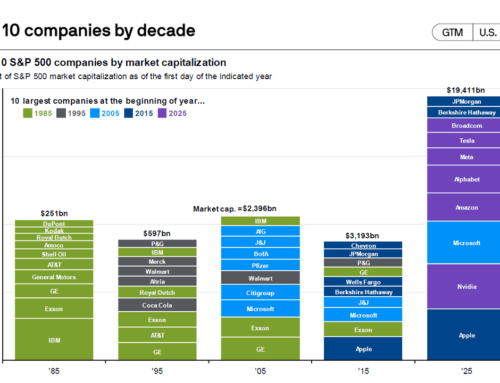

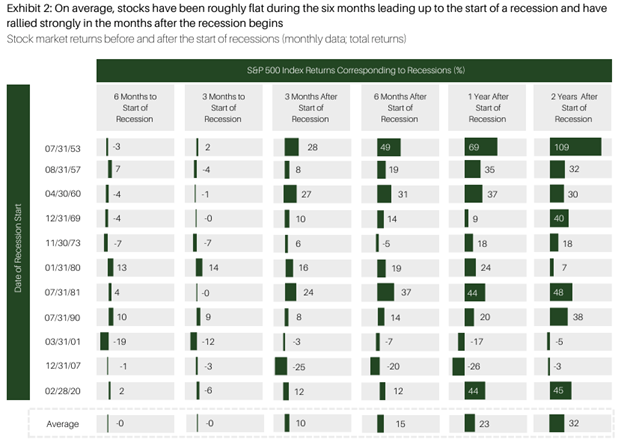

The chart below illustrates equity market returns that come after a recession and the number of recessions we have per decade. The financial plans DLK develops for its clients accounts for recessions.

Our allocation to cash and bonds is the ballast to the portfolio which helps keep portfolio values stable and cash flowing during periods of uncertainty.

We consider any concern by a client important, and where possible, attempt to provide a combination of historical perspective and financial education to reassure and provide the proper investor outlook.

Next time we will surely be talking about….

What happens if …………… wins the election?