How Much Does Your Portfolio Weigh?

The business world is back at 100% occupancy and is focused on corporate earnings and future growth, while our mainstream media locks in on the pending presidential election.

Our investment committee team reviews the changes in the market daily. There are plenty of tools available to track which companies we want to own a piece of (stock) or a different set of companies that we feel comfortable owning an obligation to pay (bond).

Yet it still takes rigor and discussion to determine whether the company will pay or that the company’s earnings will remain stable and increase over time.

In this edition of the Quality Investment Report, we will be looking at the allocation of companies within our portfolio or what is known in the industry as weighting. We also are launching a “Questions we get asked” section, and we end with a unique way to plan called C, B, A.

The Weighting is the Hardest Part

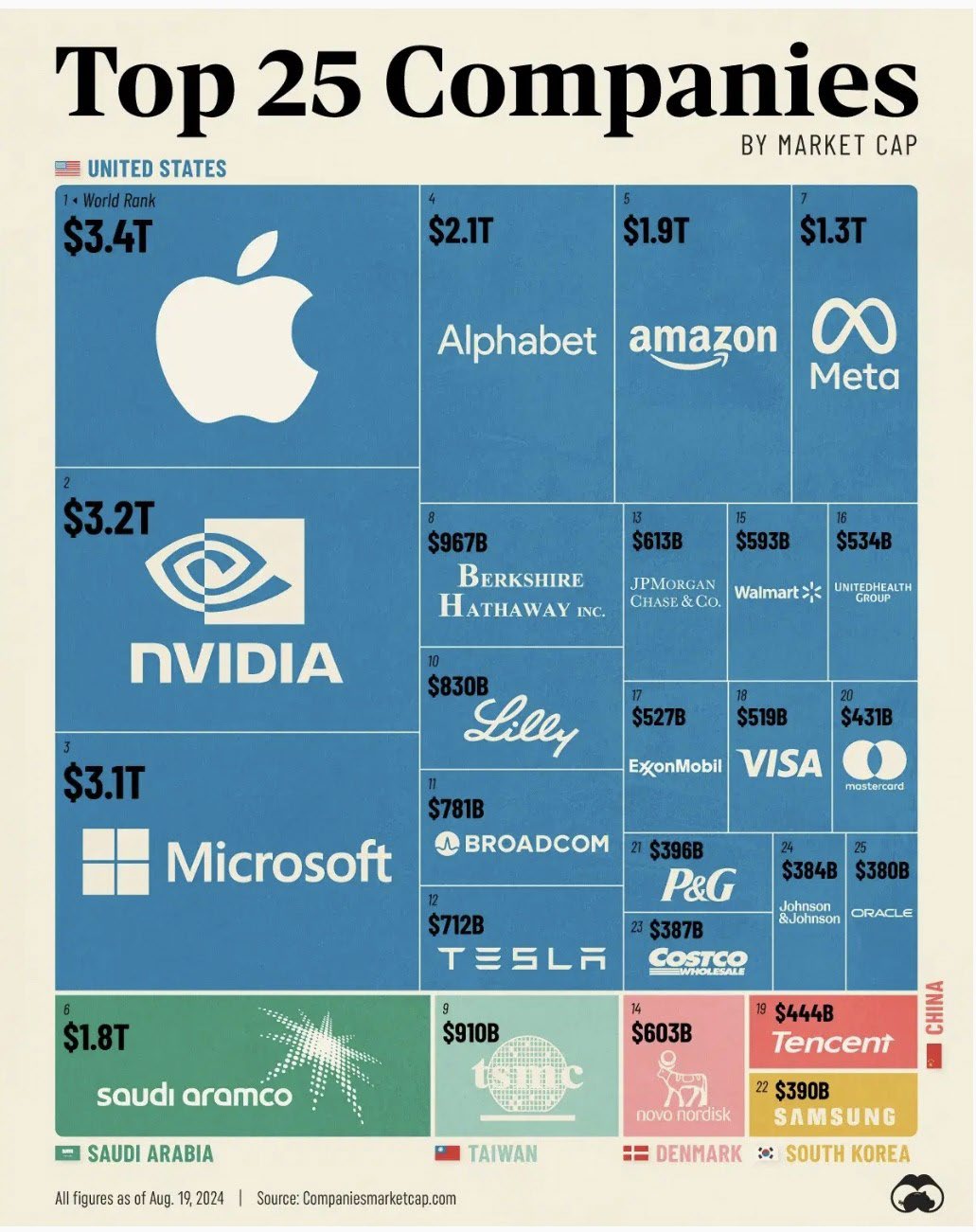

As much as we love America, we do not want to own a small piece of every public company in the United States.

Why?

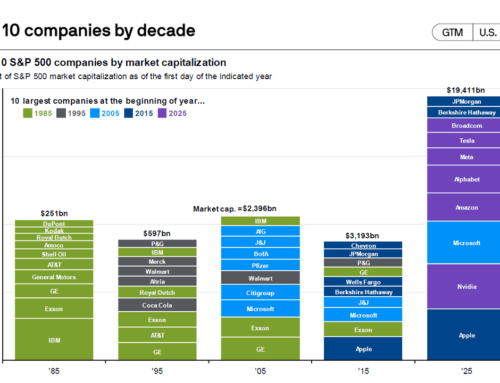

Because companies lose their advantage to control prices and margins, and their stock price drops and some go out of business. Schumpeter’s law of creative destruction is real.

We chose a set of criteria that are derivatives of our Quality Investment Process, that trim the 11 industry sectors as outlined by Standard & Poor’s, to those that we think provide excess, risk adjusted returns. Within our favorable sectors we look for companies that achieve our quality metrics, and then our favorite companies earn our investment for our clients’ precious funds.

After selection of 30 companies we must now make another important choice, what percentage of the total does it receive? As a rule, we do not want any one company to be more than 6% of the portfolio and we have a floor of 1.5% for a company as well.

While a single position can range from 1.5% to 6.0% small percentages can make a significant difference. Our investment committee discussions can be lively as the merits of one company versus another are hashed out.

We thought it might be interesting for you to understand that we use these guidelines to avoid wasting time on industry sectors that we don’t feel provide adequate risk adjusted returns, which allows us to dig in and focus on how much of the best of the best we should own.

As Tom Petty says in his song, with a slight modification for fun on our part, “It’s the weighting that is the hardest part.”