What Does a Two-Wave Hold Down

Have to do With Active Investment Management?

Tom Brenner is entering his second year on the DLK team and is an avid surfer. In one of our recent team meetings about running our Quality Investment Process it came up that the next nine months may be like being held under a huge set of waves after you have wiped out.

“Ah, yes” he smiled, “you have to be prepared for the two-wave pull down, you can’t just wing it.”

We thought this might be a good metaphor for helping people understand how we go about preparing to own equities and fixed income even when we know the economy may have some challenging times ahead.

This article from Surfing.com and an accompanying video from the Ultimate Waterman shows that it is in the preparation, the analysis, and the practice that surfers can successfully survive amidst these monster big waves.

Three actions that a surfer can practice preparing were highlighted:

- First, you should be able to hold your breath for 30 seconds underwater.

- Second, you should be able to run across the bottom of a 25-yard pool carrying 25 pounds.

- Third, you should have excellent speed in the water as a swimmer.

These actions are correlated with the knowledge that the above average wave requires the surfer to hold their breath for 12 seconds. This fact empowers them to understand they can easily handle two waves once they have proven to themselves, they can hold their breath for 30 seconds.

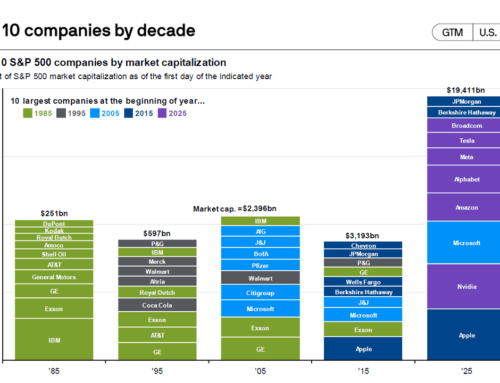

From an investing standpoint we see correlations in actions that can be taken daily while also having our attention focused on the proper time horizon. Our Quality Investment Process requires our team to be monitoring a series of leading indicators on the portfolio daily. Our team discusses these indicators and the cumulative learning and trust that builds from this is a significant advantage. Finally, on a weekly basis we determine if any changes to the allocations should be made. This is the way we prepare and act as active investment managers. You do not want to be held under for two waves, but when that happens, your training has prepared you to deal with the situation.

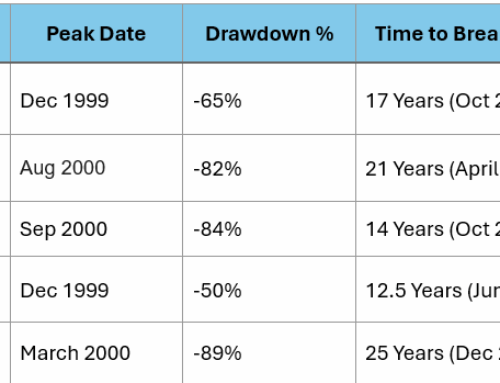

All of this is within the context of time, as in the length of time we expect to see an investment decision in equities to reach our goal. That is three years. For clients this will not come as a surprise, but for others it might. In the same way that a surfer should not surf big waves unless they can hold their breath for 30 seconds, we believe that money that is needed in less than three years should not be in equities.

When the stock market was roaring along the last ten years many people chose to forget this rule, the returns were too good to pass up. However, with the shock of March it has been reported by the WSJ that over 35% of individual investors sold at the bottom. A possible reason for this is that these people realized that even with what they had left, they still had enough, and they realized the volatility of stocks was not for them.

With hindsight being 20/20 we now know how much that sale must hurt as of today with the double-edged sword of volatility swinging back up and with the market’s currently up for the year.

Looking forward it is vital that investors and their managers be in lock step on asset allocation. Fixed Income and Money Market yields are extremely low and the potential for volatility in the equity markets is clearly high. Our Quality Investment Process is in place as is our team, we have our actions and our eyes set on the future.