Putting the F in Fiduciary

Fiscal responsibility is at the forefront of all non-profit endowment committees, however, in today’s climate it has taken on a new level of responsibility. With new governmental regulations causing fear to spread faster than the disease, the executive director is being asked to lay off staff and there is more stress on the endowment funds.

DLK’s 11-year history of advising and managing money for endowments has us in a good position to provide professional guidance for endowment committees. We are happy to get on a call with anyone whose volunteer work involves being a fiduciary for non-profit investment funds. There are three key assessments or reviews that we would recommend at this time.

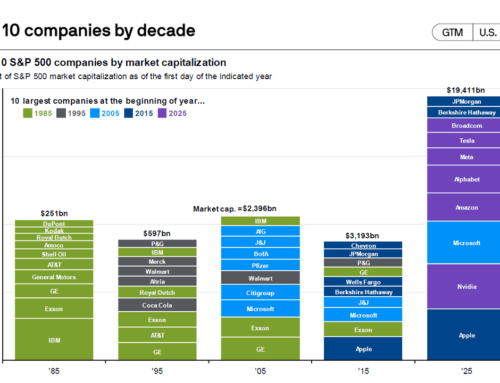

• The investment policy statement should be given a full review.

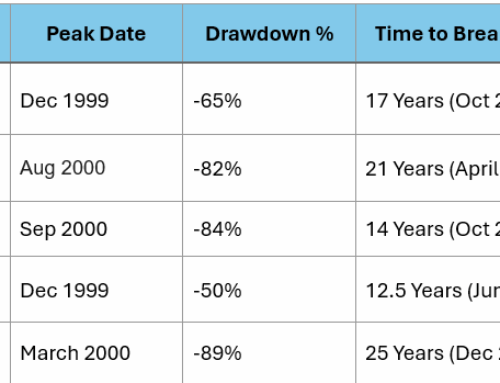

• The investment allocation should be stress tested by an outside advisor.

• A liquidity assessment should be performed with an eye towards asset and liability matching.

Non-profit organizations are being adversely impacted right now at a time when their actions and purpose are going to be needed most. Having a firm grasp of what can and can’t be expected from the endowment funds at this time are critical and we are happy to do our part to avail any unwarranted fears.