You Can Smell Risk in the Air…

The smell of risk for some is the smell of opportunity. A time to peer around the pandemic bend and find the new things that will be born during this crisis. Andy Kessler writes a weekly column for the WSJ and published an article about that very idea back in March. If you are 51% optimistic at this moment then our question is, what is your process for measuring the risks of where you are putting your money to work?

This is not the time to not know how your money is managed and it also is a horrible climate for some of the standard ways people “buy stocks and bonds.” It can be hard to tell the difference in your returns or your risk when the bull market is raging. The tide rises all boats. However, the very popular strategy of index funds struggles mightily in a recessionary period.

What is wrong with an index fund?

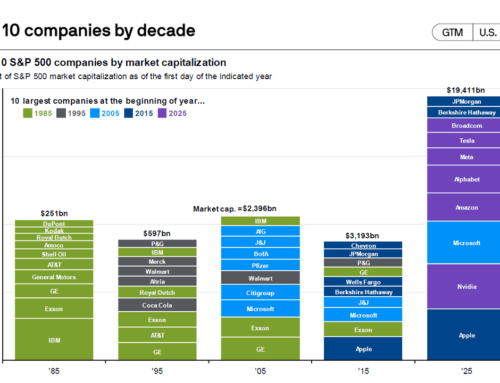

The MSCI, S&P 500, or Russell 2000 all serve as bellwethers for the investment community and are in fact a form of active management. They are governed by a series of protocols for repricing and re-balancing. Four times a year the committee for the S&P 500 meet to delete and add companies and 1500 times during the trading day the index reprices itself.

This type of allocation process does not allow for much flexibility in sector allocation and for company selection. Who would want to own an airline stock or a hotel stock right now if they did not have to? Anyone up for owning a cruise line?

In the cold light of a pandemic and its follow-on recession we think an index fund is a questionable investment tool.

Looking ahead we welcome the chance to speak to anyone you know who is feeling like there is an opportunity ahead to make sure they understand that some of what worked in the past may not be suited for the current pandemic period.