How Money Changes Family Dynamics

According to a recent article in the Wall Street Journal, 68 Trillion dollars is going to transfer from families in the next 25 years. We hear you saying to yourself, “great, except not in my case, my parents are going to end up living with us.” Yet for some, this wealth transfer is real and the cause for a different kind of concern.

You may inherit some money, but in many cases you are also inheriting an inability to talk about money between generations. This lack of communication leads to something else getting passed on to the next generation, long term wounds and enmity between surviving siblings. The fear of being perceived as greedy or needy by a sibling is enough for many to bury the conversation, we advise you to not pick up the shovel.

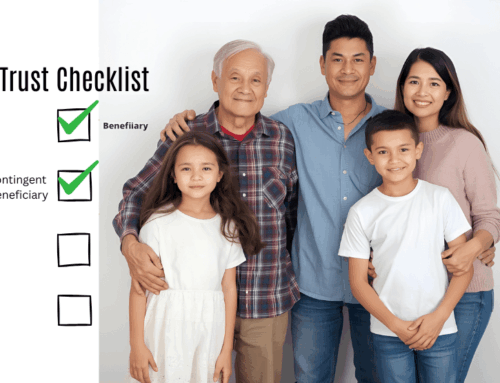

Here are some things to look if you are concerned about how your parents or parent are planning or not planning their estate.

- Has their trust been updated in the last five years?

- Were they to be disabled in an accident who gets to talk to the doctors and who gets to talk to the banker?

- If one of them handles the money and the other is in the dark, what is the plan if the one who handles the money is incapacitated for more than 60 days?

- Do your parents have similar risk tolerances when it comes to investments?

- What environment or setting allows your parents to be the most comfortable to talk and share?

Here’s the Good News! Even with all the complexities, the issues can be solved with effective listening and dialogue. When you have a question about these topics, feel free to reach out to us and we can share several solutions that have worked and how it can be accomplished in a respectful and timely manner.